30+ refinancing mortgage cash out

Web How a Cash-Out Refinance Works A cash-out refinance allows you to use your home as collateral for a new loan as well as some cash creating a new mortgage for a larger amount than what is. You can get up to 80 percent of your homes current value in a cash-out refinance.

Should I Cash Out Refinance My Mortgage Read This First Barron S

You can use the menus to select other loan durations alter the loan amount or change your location.

. Web A cash-out refinance is a new loan replacing your current mortgage. Find out when its a good idea to get one and the benefits of this type of loan. Lender PennyMacs 30-year conventional refinance rate for July 3 was 3375 and.

Web Learn what a cash-out refinance is and how to prepare for one. Current loan balance plus cash-out. This combined with the shorter term.

Web Heres how the 30 biggest cash-out refinance lenders in 2021 ranked from lowest to highest average 30-year rate. Address 1230 Peachtree St NE 1900a Atlanta GA 30309 Toll Free 800-599-1563 Local 404-238-7888 Office Hours Sunday. What is a limited cash-out refinance.

When you close on your loan youll get funds you can use for other purposes. In this example its as much as 140000. Web In a cash-out refinance you receive the difference between the balance on your previous mortgage and your new larger mortgage.

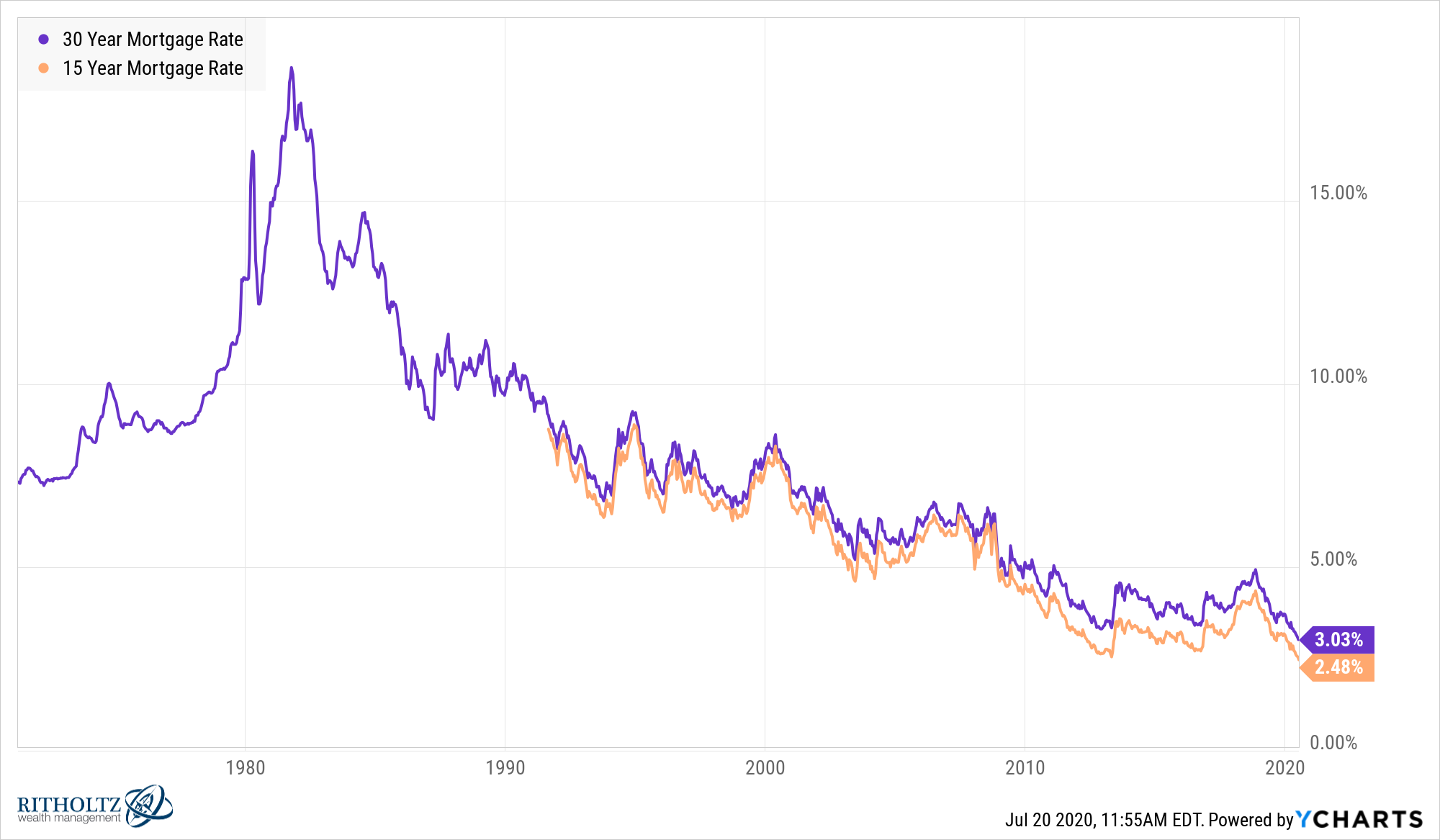

Web In the first week of February the average 15-year fixed rate was 095 percentage points lower than the average 30-year fixed rate according to Freddie Mac. Multiple the new loan amount by 25 and then subtract the difference from the original cash-out value. Sky high mortgage rates have.

Web How much money can you get in a cash-out refinance. 100000 x 025. Web Cash-out refinancing and regular refinancing of a mortgage follow the same process and this process is also known as rate-and-term refinance.

A cash-out refinance allows you to use the equity youve already earned to fund home improvements and renovations that can increase. Instead you would lose money on the exchange. With a cash-out refinance youll pay off your existing mortgage with a new larger loan and pocket the difference.

On a single-unit investment property 25 of the equity must remain in the property. From questionable design choices to a broken HVAC system upgrades are often necessary. Web Here are some reasons to consider getting a cash-out refinance.

Web Fannie Mae researchers expect prices to decline 42 in 2023 while the Mortgage Bankers Association expects a 06 decrease in 2023 and a 12 decrease in 2024. Deduct the equity youll keep in the investment. Fund Home Improvements And Renovations.

300000 200000 100000. 11 2022 This chart displays offers for paying partners which may impact the order in which they appear. Web See how refinancing with a lower mortgage rate could save you money.

These lenders specialize in select loan types and may not help every. Home Mortgage The Benefits of Cash-Out Refinancing. Web A cash out refinance would yield you a better rate if you bought your home in 2008 when the 30-year fixed was 603.

Web A cash-out refinance allows homeowners to withdraw some home equity as cash while updating their mortgage rate and term. Federal Reserve Bank of St. Equity kept in property.

Web What is a cash-out refinance. Web Maximum cash-out value. You typically receive the cash shortly after.

Web How Does a Cash-out Refinance Work. This is when you can replace your old loan with a new one but for a shorter loan term and a lower interest rate. Determine the lenders minimum requirements Mortgage lenders have different qualifying requirements for cash-out refinancing.

If you have 5000 in closing costs the time it takes to recoup that amount depends on the terms of your mortgage. Web You may pay a higher interest rate or more points on a cash-out refinance than on a standard refinance. Web The following table shows current 30-year mortgage rates available in Redmond.

A limited cash-out refinance allows homeowners to refinance at a more favorable rate andor term while receiving a limited amount of cash no greater than 2 of the new loan balance or 2000. Mortgage terms can range from 15 to 30 years or even longer. Web Cash-out refinancing is a type of mortgage refinance that allows you to borrow more than your current mortgage balance and keep the difference.

Web Heres how you might prepare for a cash-out refinance. A cash-out refinance lets you access your home equity by replacing your existing mortgage with a new one that has a higher loan amount than what you currently owe. Youll be borrowing what you owe on your existing loan plus the cash you take out from your homes equity.

Mortgage Rates for Dec. However with cash out refinancing you can get a higher portion of your homes. If you bought your home in 2012 when the average rate was 366 a cash out refinance will not magically gift you an even lower rate.

1 Is a cash-out refinance the right move for you. Web A cash-out refinance is a mortgage refinancing option in which an old mortgage is replaced with a new one. 30-Year Fixed Rate Mortgage Average in the.

Today S Cash Out Refinance Rates Forbes Advisor

Mortgage Rates Are Insanely Low

Fha Streamline Refinance Rates Guidelines For 2023

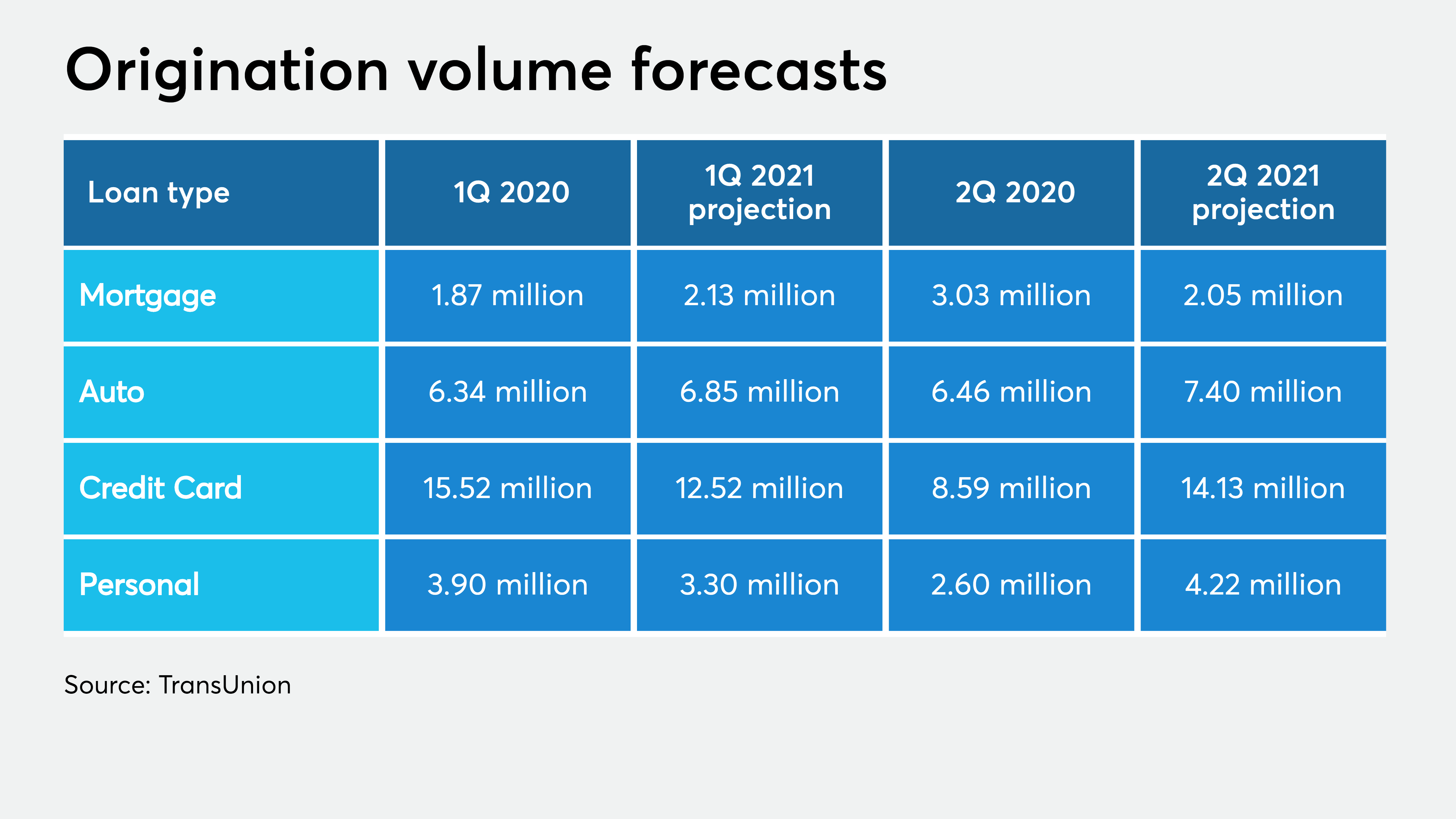

2021 Forecast Predicts Cash Out Refinance Activity Spike National Mortgage News

What Does It Mean To Refinance A Loan Driva

Cash Out Refinance Requirements 2022 Bankrate

The Ups And Downs Of Cash Out Refinance In Texas Texaslending Com

Mr Cooper Reviews 360 Reviews Of Mrcooper Com Sitejabber

Adjustable Rate Mortgage Monthly Bill Payment Checklist

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Mortgage Lender Woes Wolf Street

Cash Out Refinance Guide Rocket Mortgage

Mortgage Loan Ad

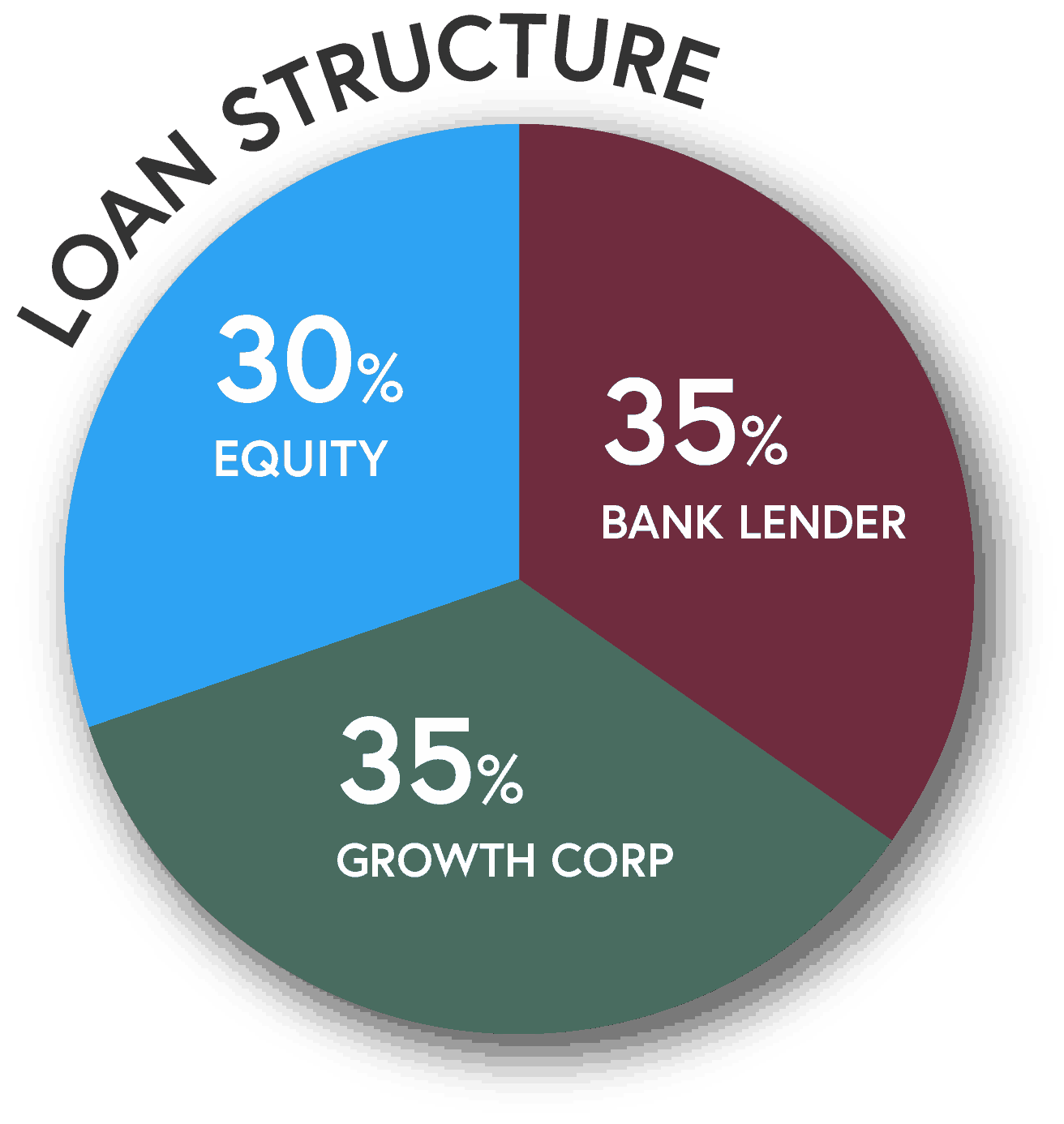

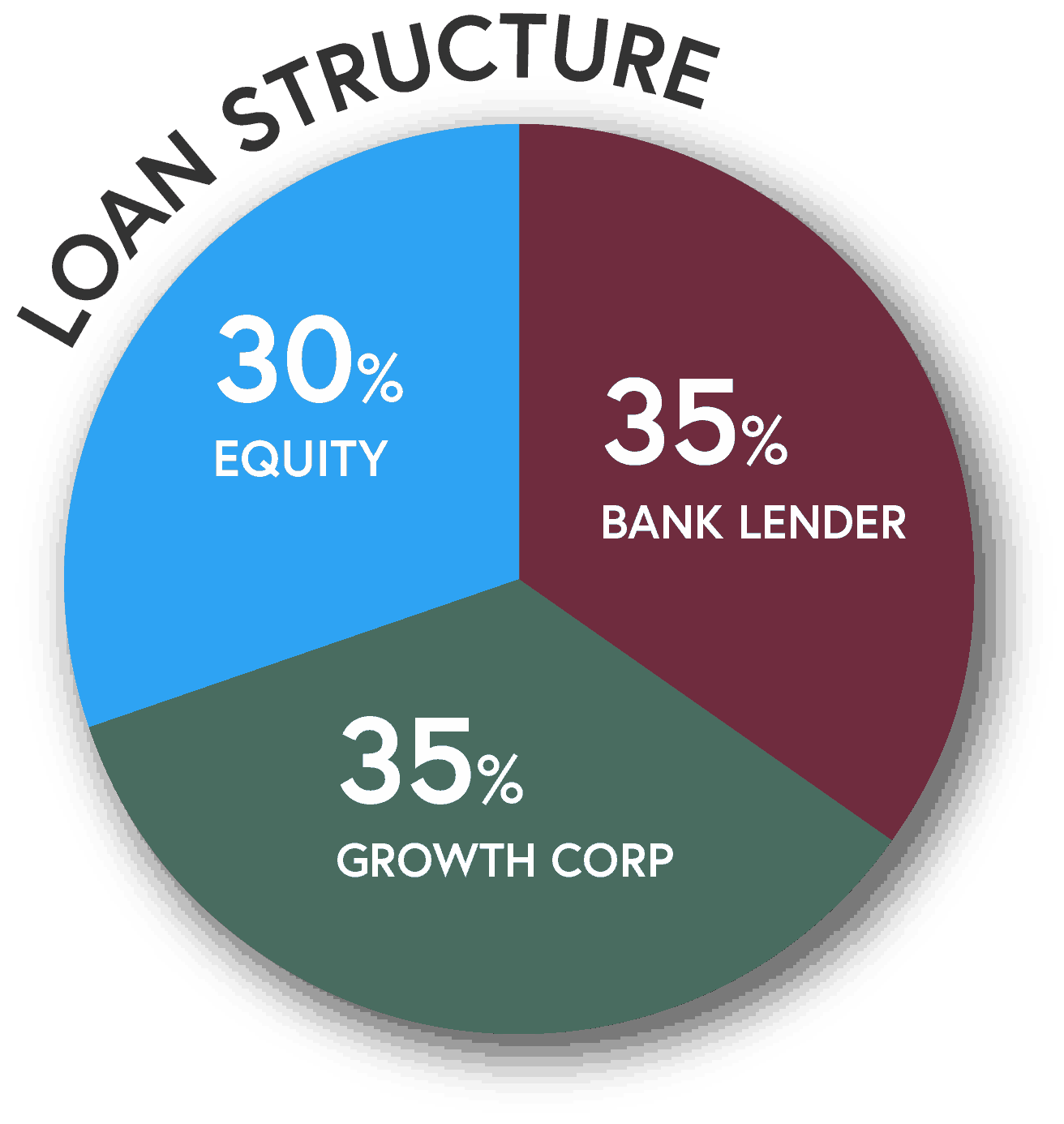

Refinance Growth Corp

Refinance Home Loans Tips For 2023 Mortgage Choice

Cash Out Refinance Mortgage Refinance U S Bank

Cash Out Refinance How It Works And What To Know Nerdwallet